SBI Home Loan Prepayment Calculator: Calculate Prepayment of SBI Home Loan

Table of Content

Monthly Maintenance Expenses is what you pay to keep your apartment shining, clean and ‘water-full’. If its an independent house, you can assume your annual maintenance expenditure to be about one percent of your home value. Divide this number by 12 to arrive at monthly maintenance amount. We'll ensure you're the very first to know the moment rates change. Does SBI home loan take the salary of the spouse into consideration? If the spouse is the co-owner of the property that is being bought with the loan, or is a guarantor of the loan, then the salary of the spouse is taken into account when determining the loan amount.

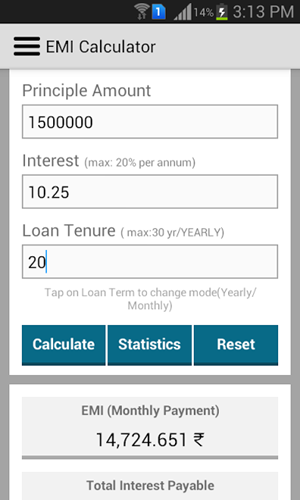

By hand, you will be forced to spend long hours to calculate loans and thier respective EMIs. However, with this online tool, you have the advantage of saving your important time and complete all the lengthy and boring calculations in seconds. That being said, you can try out as many combinations for amount, tenure and rates of interest which you want to from the convenience of your home. Loan Insurance is the single premium amount, for the Home Loan Protection Plan OR Term Insurance Plan, that gets included in your home loan amount. If you want to guesstimate this amount, use the LIC premium calculator to calculate yearly premium for eTerm plan using your age, loan term and loan amount for Sum Assured.

Customer Service

The rest of the country can avail of this offer on home loans in the bracket of 30 Lakhs and 2 crores. The SBI Home loan calculator provides an accurate projection of the EMIs. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance.

Inputting the required values will help you find out the accurate amount of EMI. It is recommended to calculate your EMI using a housing loan EMI calculator before you apply for a loan. The bank is providing lower interest rates during the festive season. Under the offer, the home loan interest rates range between 8.40% and 9.05%.

Amortisation Schedule for a Home Loan of Rs 10,00,000 over 10 Years (120 Months)

This is why it is recommended to use the SBI Home Loan EMI Calculator before getting the loan. The borrower can use the SBI Home Loan EMI Calculator to calculate this EMI amount before the EMI payments begin or even before taking the loan. The calculator has a specific algorithm that calculates the EMI value and is always accurate with its results. Since it is online, anyone can access it, and makes home loan planning hassle-free.

Since it is also a debt, SBI takes into account the salary or income of the applicant before deciding the loan amount. Urban Money is India’s one of the unbiased loan advisor for best deals in loans and unmatched advisory services. We manage the entire borrowing process for clients, starting by assisting our clients to choose the right product from the appropriate lending organization,till the time, the entire loan is disbursed. Suppose you take a home loan of INR 50,00,000 at an annual Interest rate of 9%.

Calculate Home Loan EMI

This variant of SBI home loan is very useful for young salaried between years. The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure. By clicking "Proceed" button, you will be redirected to the resources located on servers maintained and operated by third parties. SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. When you opt for part payment of your home loan, then the amount of principal outstanding is lowered significantly. The remaining reduced amount of principal also results in lower interest liabilities & EMI reduction subsequently.

Use home loan EMI Calculator to calculate monthly EMI based on sanction or desired amount, rate of interest and tenor. This online tool will give you ratio of housing loan principal amount & interest to be paid. Also check lowest EMI and highest EMI based on repayment period. An EMI is a monthly payment paid by the borrower to the creditor.

If the loan has a fixed interest rate, then it will have the same EMI amount throughout the tenure. The only difference will be in the interest amount and principal repayment. With time, in the total EMI amount, the principal portion will increase, and the interest portion will decrease. The below table of the first 12 payments will make this clear. The process of comparing the loans offered by different providers can often become very boring and time-consuming as you are using the same formula over and over again.

SBI Surakhsha State Bank of India's SBI Suraksha is a life insurance policy linked to the bank's home loan. The premium of this life insurance policy is paid by the bank. The repayment duration is the same as the tenure of the home loan as Equated Monthly Instalments .

The home EMI calculator will help you make a better decision about your part payment amounts. The online SBI Home Loan EMI Calculator provides an accurate estimate of the EMI amount that needs to be paid to clear eth debt. Knowing this amount beforehand can help with planning the monthly budgets and see if the borrower will be able to pay the amount timely without any defaults.

SBI Home Loan gives you the best interest rate of 8.05% for your dream home loan. You can also check the details of your loan by using the SBI home loan EMI calculator which tells you the total interest on your loan for a desired tenure. Interest rate concession of 25 basis points would be provided to borrowers with more than 75 Lakhs home loans. It is to be noted that the interest rate concessions are directly linked to the applicants' credit scores.

Step 3 - You need to provide the applicable interest rate of your existing home loan. Please refer to our General Schedule of Features and Charges to know more. I really appreciate Kotak Bank & the team for their efforts in helping me buy my first home. Easy to use- It is a simple and user-friendly home loan EMI calculator anyone can use. The next steps involve making sure one fulfills all the criteria of eligibility and arranging all the necessary documents. You can also negotiate a bit on the rate with the loan provider.

Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. Take a balance transfer loan- These loans are offered at lower rates of interest. Choose a long repayment tenure- Long repayment tenure give your more time to repay your loan and hence the EMI is also reduced.

Comments

Post a Comment